Research Suggestions at the end of the literature review

Introduction

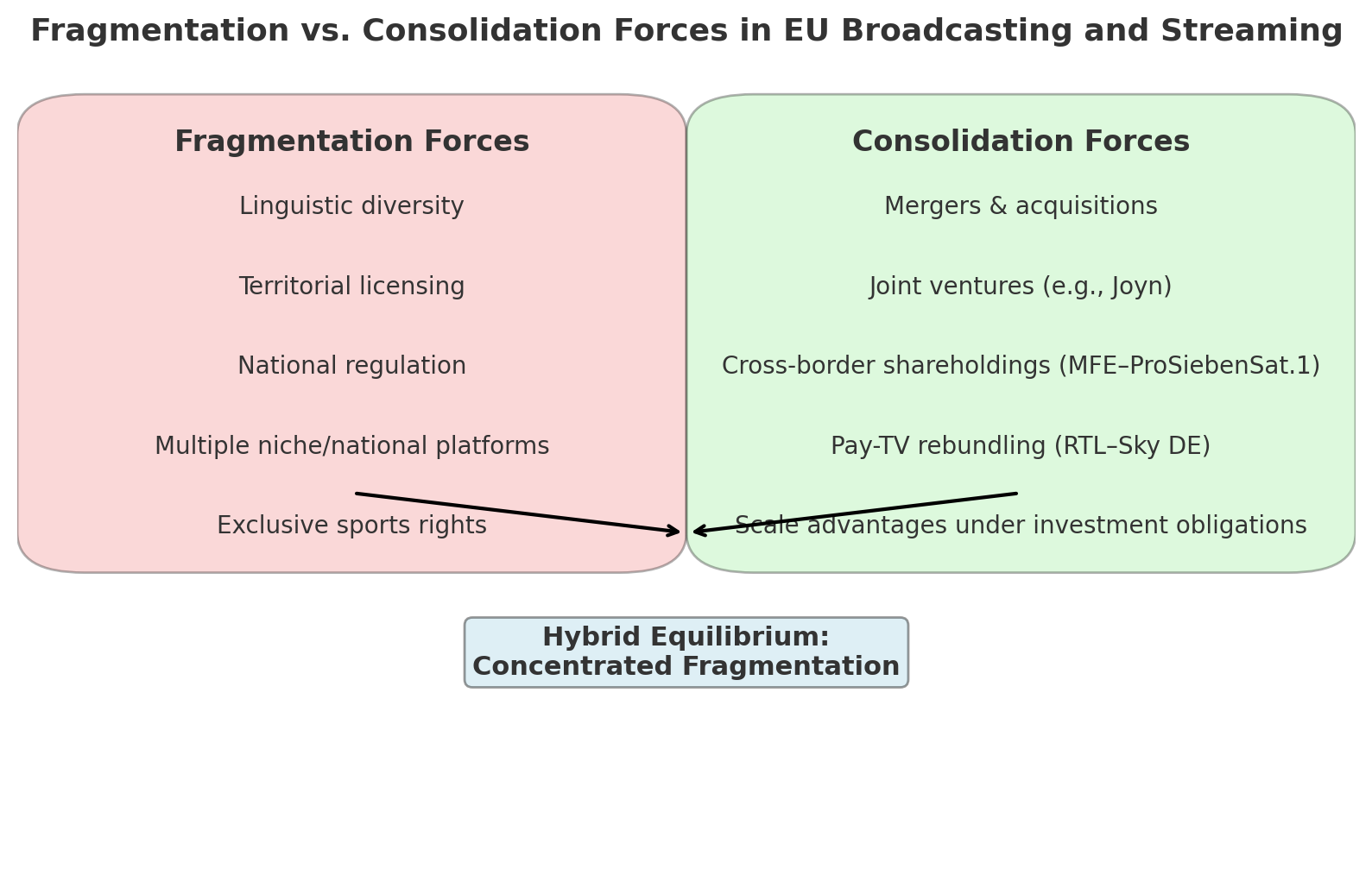

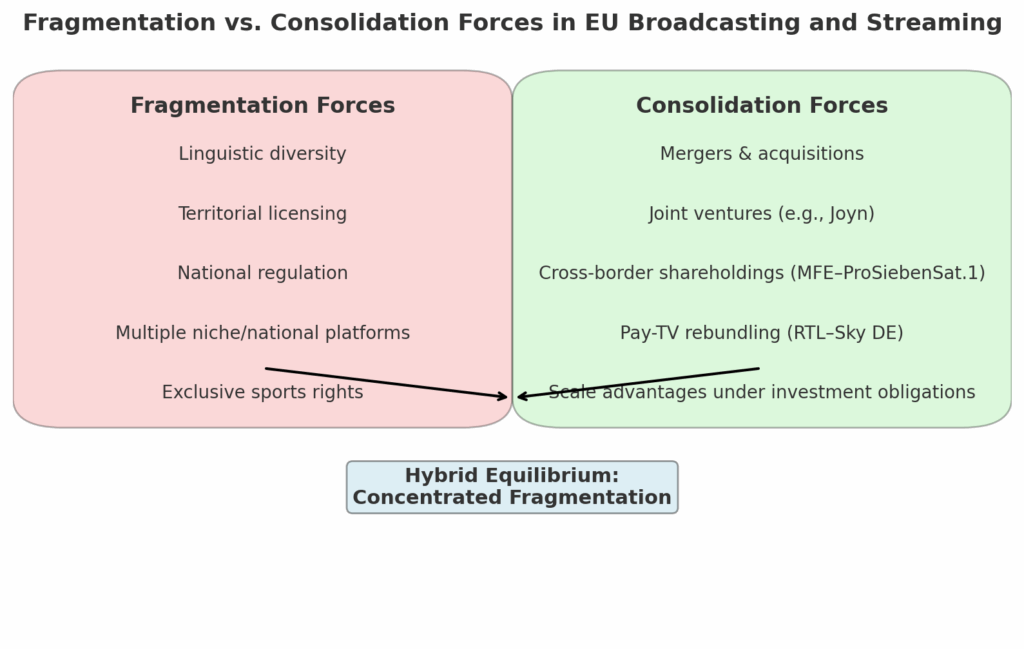

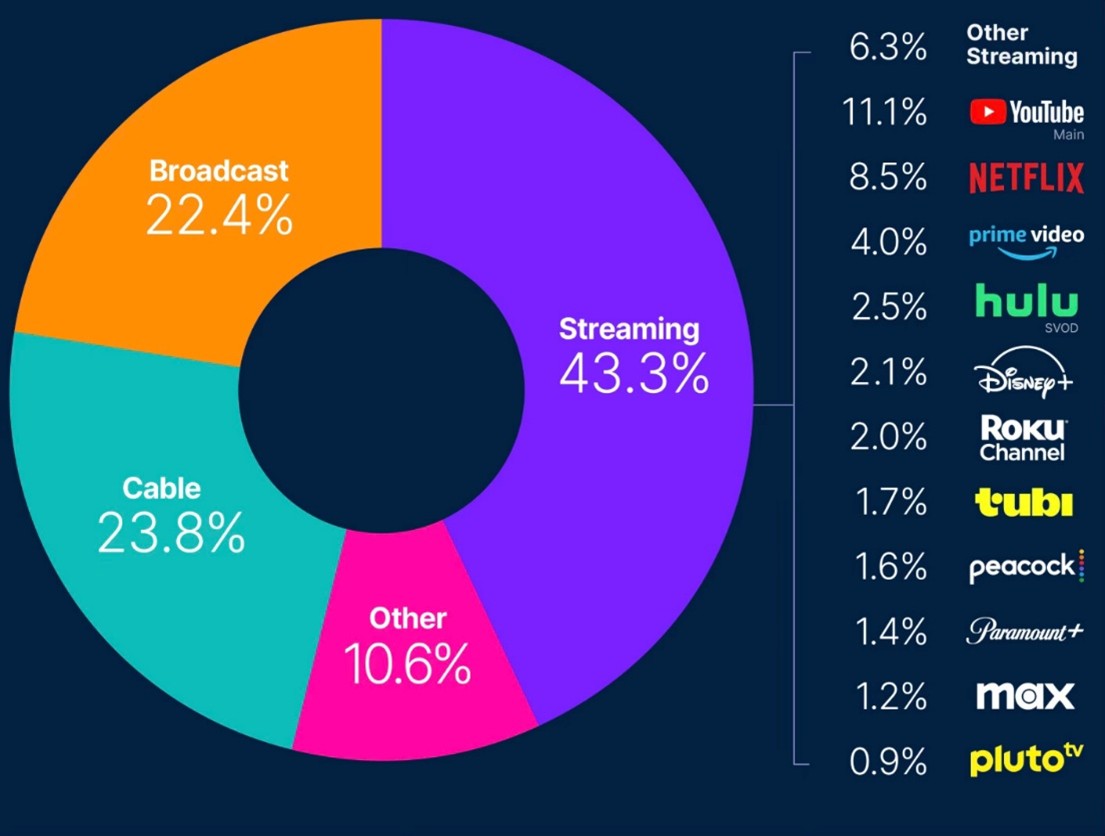

Obesity and overweight are significant global health concerns (Wongtongtair, 2021), (Baranowski, 2015), (Selvaraj, 2024), with far-reaching consequences for individuals and healthcare systems. The pervasiveness of media in modern life presents both challenges and opportunities in addressing this epidemic. This review examines various media interventions designed to combat obesity and overweight, analyzing their effectiveness, limitations, and potential for future development. We will explore diverse approaches, including video games, mobile health applications, social media campaigns, mass media campaigns, and educational programs delivered through digital platforms. A critical evaluation of the existing literature will highlight successful strategies, identify research gaps, and propose avenues for improving future interventions.

Video Games and Exergames as Interventions

The potential of video games to influence health behaviors, particularly in relation to obesity, is a growing area of research (Baranowski, 2015). Tom Baranowski’s work (Baranowski, 2015) highlights “Games for Health” (G4H) as a promising approach, utilizing entertainment game technology to achieve health goals. A systematic review identified 28 studies, with 40% showing positive influences on obesity-related behaviors (Baranowski, 2015). Games targeting dietary changes have demonstrated success in increasing fruit and vegetable consumption (Baranowski, 2015), , , . However, the effectiveness of exergames, which incorporate physical activity into gameplay, may be limited without consistent supervision (Baranowski, 2015), , , . While exergames can provide intense workouts in controlled settings (Baranowski, 2015), , maintaining engagement and exertion levels outside of these environments poses a significant challenge (Baranowski, 2015). Further research is needed to understand how to sustain engagement and translate short-term gains into long-term lifestyle changes (Bissell, NaN), (Calcaterra, 2023). A study examining the effectiveness of Wii exergames on children’s enjoyment, engagement, and exertion in physical activity showed promising results (Bissell, NaN), suggesting that this type of media intervention could be a valuable tool. The games’ instructional models were effective in engaging children, potentially leading to increased energy expenditure and reduced sedentary behavior (Bissell, NaN). However, the study was a pilot study and further research is needed on larger populations, especially targeting those already battling obesity (Bissell, NaN).

Mobile Health (mHealth) and Smartphone Applications

The rise of smartphones and mobile technology has created new avenues for delivering health interventions (Wongtongtair, 2021), (Watanabe-Ito, 2020), (Seid, 2024), (Volkova, 2017). A study comparing mobile health education messages to face-to-face consultation for weight reduction in overweight female adolescents in Thailand found significant weight reduction in both intervention groups (Wongtongtair, 2021). This highlights the potential of mobile health education to empower individuals and improve health behaviors (Wongtongtair, 2021). Another study utilized a smartphone app for creating dietary diaries and social media interaction to promote healthy eating habits among college students (Watanabe-Ito, 2020). This intervention resulted in a significant increase in interest in eating habits and a decrease in self-evaluation of eating habits (Watanabe-Ito, 2020), suggesting that digital tools can effectively raise awareness and encourage critical thinking about dietary choices (Watanabe-Ito, 2020). A systematic review of randomized controlled trials confirmed that internet-based smartphone apps consistently improved consumers’ healthy eating behaviors (Seid, 2024). The review found that 52% of offline-capable smartphone apps were successful in promoting healthier eating habits, demonstrating the effectiveness of these interventions across diverse groups (Seid, 2024). However, a study evaluating a mobile health obesity prevention program in young children found no significant intervention effect on fat mass index when compared to a control group (Works, 2020), highlighting the need for well-designed and targeted interventions (Works, 2020). Recruitment strategies for smartphone-delivered interventions are also crucial, with social media advertising, particularly Facebook campaigns, proving effective (Volkova, 2017). Culturally relevant materials are essential for maximizing reach and engagement within diverse populations (Volkova, 2017).

Social Media Campaigns and Interventions

Social media platforms offer significant potential for reaching large audiences and promoting health behavior change (Luo, 2024), (Sendyana, 2024), (Selvaraj, 2024), (Rukmini, 2021), (Prybutok, 2024), (Acha, 2022), (Osei-Kwasi, NaN), (Modrzejewska, 2022), (Chen, 2024), (Bacheva, 2024). A narrative review synthesized evidence on the individual-level effects of social media campaigns related to healthy eating, physical activity, and healthy weight (Luo, 2024). The review found that actively engaging users tends to be more effective than passive information dissemination (Luo, 2024). A campaign designed to reduce sugar consumption among adolescents in Indonesia utilized Instagram and YouTube, delivering educational content about hidden sugars (Sendyana, 2024). While the campaign effectively increased knowledge (Rukmini, 2021), translating this knowledge into behavior change presented challenges (Rukmini, 2021). Another study in Indonesia focused on the impact of an Instagram campaign on healthy eating among college students (Rukmini, 2021). Although the campaign increased knowledge, it did not lead to significant changes in eating habits (Rukmini, 2021), suggesting that knowledge alone is insufficient for behavior change (Rukmini, 2021). A study examining the impact of obesity-related social media content on urban men in India found that attention to social media content positively influenced knowledge of health behaviors, leading to behavior change (Selvaraj, 2024). The study recommended frequent sharing of informative posts from health experts to raise awareness (Selvaraj, 2024). Social media can also create supportive communities, as demonstrated by a study showing that communication with friends on social media enhanced understanding of weight management conversations (Prybutok, 2024). However, challenges remain, including misinformation, privacy concerns, and the need for sustained engagement (Acha, 2022). A case study approach examined interventions using YouTube, Instagram, and Facebook, highlighting the importance of platform-specific features and community support (Acha, 2022). The study emphasized that social media interventions should augment, not replace, in-person treatment (Acha, 2022). A youth-led social marketing intervention in Spain utilized peer influence to promote healthy lifestyles, targeting socioeconomically disadvantaged youth (Llaurad, 2015). The intervention aimed to increase fruit and vegetable consumption and reduce screen time (Llaurad, 2015). Social media’s influence on body image and eating patterns is also significant (Modrzejewska, 2022), potentially contributing to obesity (Modrzejewska, 2022). However, social media can also be a valuable resource for obesity prevention and treatment, providing information and social support (Modrzejewska, 2022). A study in China linked digital media consumption to increased obesity rates among adolescents and young adults (Chen, 2024), highlighting the need for targeted interventions (Chen, 2024). A study in Bulgaria showed that social media is a primary source of information regarding healthy eating among youth (Bacheva, 2024), suggesting that targeted social media campaigns could be a powerful tool for promoting healthier lifestyles (Bacheva, 2024).

Mass Media Campaigns

Mass media campaigns have been employed to address obesity through public health messaging (Morley, 2018), (Falbe, 2017), (Kraak, 2021), (Gerberding, 2004), (Smith, 2015), (Dixon, 2018), (Capito, 2022). The LiveLighter campaign in Australia successfully reduced sugar-sweetened beverage consumption and increased water consumption among overweight and obese individuals (Morley, 2018). This multi-faceted campaign utilized television, radio, cinema, and online advertising (Morley, 2018). Another campaign focused on discouraging sugar-sweetened beverage consumption, highlighting their contribution to obesity, diabetes, and heart disease (Falbe, 2017). A systematic scoping review developed a typology of media campaigns to evaluate their collective impact on promoting healthy hydration behaviors and reducing sugary beverage health risks (Kraak, 2021). The typology included corporate advertising, social marketing, public information campaigns, and media advocacy (Kraak, 2021). The Centers for Disease Control and Prevention’s (CDC) VERB campaign utilized social marketing strategies to promote physical activity among tweens (Gerberding, 2004), showcasing the power of partnerships with athletes and celebrities (Gerberding, 2004). A study examining audience perceptions of mass media messages on physical activity revealed that messages about the risks of inactivity, particularly concerning obesity, were most readily recalled (Smith, 2015). However, there was a perceived lack of practical advice, indicating a need for more engaging and informative campaigns (Smith, 2015). The impact of unhealthy food sponsorship in sports on young adults’ food preferences was also investigated (Dixon, 2018), demonstrating that pro-health sponsorship models can enhance positive brand awareness (Dixon, 2018). Developing effective mass media campaigns requires careful consideration of messaging, target audience, and dissemination channels (Capito, 2022). Involving consumers in the campaign development process significantly enhances effectiveness (Capito, 2022).

Educational Programs and Interventions

Educational interventions, often delivered through media, play a crucial role in obesity prevention and treatment (Robinson, 2010), (Peterson, 2015), (Austin, 2012), (Mauriello, 2006), (Mandi, 2020), , (Gianfredi, 2021), (Binder, 2021). The Melbourne InFANT Program targeted first-time parents to influence child-focused obesity prevention (Hesketh, 2011), positively affecting maternal beliefs about television’s role in development and diet (Hesketh, 2011). This resulted in children in the intervention group watching less television and consuming more fruits and vegetables (Hesketh, 2011). The Healthy Choices program, a multi-component obesity prevention program targeting middle school students, showed significant increases in weight-related behaviors over three years, including increased fruit and vegetable consumption, reduced television watching, and increased physical activity (Peterson, 2015). The Planet Health intervention in Massachusetts middle schools demonstrated that higher exposure to lessons aimed at reducing television viewing was associated with lower odds of disordered weight control behaviors (Austin, 2012). A computer-based obesity prevention program for adolescents utilized individualized feedback based on readiness to engage in healthy behaviors (Mauriello, 2006), targeting television viewing reduction (Mauriello, 2006). A study promoting physical activity among medical students combined a web-based approach and motivational interviews (Mandi, 2020), demonstrating the effectiveness of multicomponent interventions (Mandi, 2020). A nutritional intervention using pictorial representations in Brazil significantly improved dietary knowledge and practices among adolescents , increasing vegetable consumption and reducing soft drink intake . The COcONUT project used theatrical and practical workshops to improve children’s adherence to the Mediterranean Diet (Gianfredi, 2021). A typology of persuasive strategies for presenting healthy foods to children was proposed, outlining composition-related, source-related, and information-related characteristics (Binder, 2021). The study highlighted the lack of conclusive studies on the effects of healthy food presentations compared to unhealthy ones (Binder, 2021), indicating a need for further research in this area (Binder, 2021).

Addressing Specific Populations and Cultural Considerations

The effectiveness of media interventions is influenced by cultural context and target audience (Osei-Kwasi, NaN), (Robinson, 2010), (Okpanachi, 2024), (Molenaar, 2021), (Aleid, 2024). A culturally tailored diet and lifestyle intervention for African and Caribbean people in Manchester utilized social media interactions and a fitness mobile application to enhance engagement and promote healthy behaviors (Osei-Kwasi, NaN). The study highlighted the benefits of a culturally tailored approach and an all-African delivery team (Osei-Kwasi, NaN). A community-based obesity prevention program for low-income African American girls included culturally tailored dance classes and a home-based intervention to reduce screen media use (Robinson, 2010). While BMI changes did not significantly differ between groups, secondary outcomes, such as improved cholesterol levels and reduced depressive symptoms, were observed (Robinson, 2010). The development of Food Villain, a serious game designed to influence healthy eating habits among African international students, addresses cultural, environmental, and behavioral factors impacting dietary choices (Okpanachi, 2024). The game’s web-based and virtual reality versions aim to enhance engagement and motivation (Okpanachi, 2024). A study examining young adults’ engagement with social media food advertising in Australia highlighted the influence of advertisements on food choices and perceptions of health (Molenaar, 2021). Participants expressed feelings of guilt related to unhealthy eating behaviors influenced by advertising (Molenaar, 2021). A study in Saudi Arabia found that social media food advertisements significantly influenced unhealthy eating behaviors, emphasizing the need for policy interventions to regulate food advertising and promote physical activity (Aleid, 2024).

Framing Effects and Persuasive Strategies

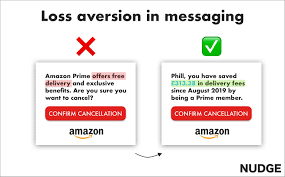

The way health messages are framed significantly impacts their effectiveness (Binder, 2020), (Faras, 2020), (Requero, 2021). A study investigating gain- and loss-framed nutritional messages found that gain-framed messages increased awareness and healthy eating behavior among children aged 6-10 (Binder, 2020). Children exposed to gain-framed messages showed a higher intake of fruits compared to the control group (Binder, 2020). Another study examined the effectiveness of fear versus hope appeals in health advertisements (Faras, 2020). Individual characteristics, such as self-efficacy and fast food consumption frequency, moderated the effectiveness of these appeals (Faras, 2020). The study highlighted the importance of tailoring messages to individual differences (Faras, 2020). A review explored how healthy eating campaigns can change attitudes and behaviors through persuasion processes (Requero, 2021). The review emphasized the significance of elaboration and perceived validity of thoughts in mediating persuasion (Requero, 2021). Different modalities of information presentation (verbal, visual, physical experiences) can also influence effectiveness (Requero, 2021).

Parental Involvement and Family-Based Interventions

Parental involvement plays a critical role in shaping children’s eating habits and physical activity levels (Lepeleere, 2017), (Hesketh, 2011), (Modrzejewska, 2022), (Haines, 2018), (, NaN), (, NaN). An online video intervention aimed at promoting positive parenting practices related to children’s physical activity, screen time, and diet showed some improvements in physical activity levels in older children (ages 10-12) (Lepeleere, 2017), but no significant effects on children’s diet were found (Lepeleere, 2017). The Melbourne InFANT Program showed promising impacts on parental attitudes and beliefs, influencing children’s diet and television viewing behaviors (Hesketh, 2011). Parental food preferences and knowledge significantly affect children’s food choices (Modrzejewska, 2022), and social media can further influence these behaviors (Modrzejewska, 2022). A home-based obesity prevention intervention among families with children aged 1.5 to 5 years showed significant improvements in fruit intake and a reduction in the percentage of fat mass in one intervention group compared to the control group (Haines, 2018). A review highlighted that long screen time negatively affects sleep duration and quality, which can contribute to obesity (, NaN). A weight management program based on self-determination theory (SDT) that included structured exercise and parental involvement showed improvements in psychological aspects, even though weight loss was not achieved (, NaN). The study highlighted the role of parental support and the importance of improving communication patterns within families (, NaN).

Limitations and Future Directions

While the studies reviewed demonstrate the potential of media interventions in addressing obesity and overweight, several limitations and research gaps need to be addressed. Many studies have limitations in terms of sample size, methodological rigor, and follow-up periods. Longitudinal studies are needed to assess the long-term effectiveness of interventions (Luo, 2024), (Acha, 2022). The effectiveness of interventions may vary across different populations and cultural contexts (Osei-Kwasi, NaN), (Robinson, 2010), (Okpanachi, 2024). More research is needed to understand the mechanisms through which media interventions influence behavior change (Anton, 2014). The role of individual characteristics, such as self-efficacy and motivation, needs further investigation (Faras, 2020), (Requero, 2021). The development of more engaging and culturally appropriate materials is crucial for maximizing reach and impact (Volkova, 2017), (Capito, 2022). Furthermore, the ethical considerations of using social media in health interventions, including data privacy and the potential for exacerbating health disparities, must be addressed (Acha, 2022). The integration of media interventions into broader community-based programs is also crucial for sustained impact (Jeffery, 2006). Finally, the cost-effectiveness of different media interventions needs to be evaluated to guide resource allocation (Volkova, 2017).

Media interventions hold significant promise for reducing obesity and overweight. Various approaches, including video games, mobile health applications, social media campaigns, mass media campaigns, and educational programs, have demonstrated effectiveness in influencing dietary habits, physical activity levels, and other obesity-related behaviors. However, the effectiveness of these interventions varies greatly depending on factors such as the specific approach, target population, cultural context, and message framing. Future research should focus on addressing the limitations of existing studies, improving methodological rigor, and developing culturally tailored interventions that address the specific needs and challenges of different populations. A multi-pronged approach involving multiple sectors of society, including healthcare professionals, educators, policymakers, and the media, is essential for creating a supportive environment that encourages healthy eating and physical activity. By leveraging the power of media effectively, we can contribute significantly to combating the global obesity epidemic.

References

(NaN). The relationship between the use of digital devices and sleep quality, physical activity and eating behavior in preschool children. None. https://doi.org/10.17759/jmfp.2022110206

(NaN). Weight management program based on self-determination theory: comparing parents-child data.

Acha, J. O., Azai, J. S., Adesina, O. B., & David, M. L. (2022). The role of social media in enhancing behavioral health interventions: a case study approach. World Journal of Advanced Research and Reviews. https://doi.org/10.30574/wjarr.2022.13.3.0146

Aleid, S., Alshahrani, N. Z., Alsedrah, S., Carvalho, A., Lima, M. J., Teixeira-Lemos, E., & Raposo, A. (2024). The role of social media advertisement and physical activity on eating behaviors among the general population in saudi arabia. Nutrients. https://doi.org/10.3390/nu16081215

Anton, S. (2014). Can nonnutritive sweeteners enhance outcomes of weight loss interventions? Obesity. https://doi.org/10.1002/oby.20779

Austin, S. B., Spadano-Gasbarro, J. L., Greaney, M., Blood, E. A., Hunt, A., Richmond, T. K., Wang, M. L., Mezgebu, S., Osganian, S., Peterson, K. E., Hospital, B. C. ‘., & Boston, M. (2012). Effect of the planet health intervention on eating disorder symptoms in massachusetts middle schools, 20052008. Preventing Chronic Disease. https://doi.org/10.5888/pcd9.120111

Bacheva, M., Todorova, D., Obreykova, M., & Andonova, A. N. (2024). Study of the eating habits and behavior of bulgarian students and their impact on their health. Journal of IMAB. https://doi.org/10.5272/jimab.2024303.5664

Baranowski, T. (2015). Might video games help remedy childhood obesity? Childhood Obesity. https://doi.org/10.1089/chi.2015.98999.tb

Binder, A., Naderer, B., & Matthes, J. (2020). The effects of gain- and loss-framed nutritional messages on childrens healthy eating behaviour. Cambridge University Press. https://doi.org/10.1017/s1368980019004683

Binder, A., Naderer, B., & Matthes, J. (2021). Shaping healthy eating habits in children with persuasive strategies: toward a typology. Frontiers in Public Health. https://doi.org/10.3389/fpubh.2021.676127

Bissell, K. L., Zhang, C., & Meadows, C. W. (NaN). A wii, a mii, and a new me? testing the effectiveness of wii exergames on children”s enjoyment, engagement, and exertion in physical activity. None. https://doi.org/None

Calcaterra, V., Vandoni, M., Marin, L., Pellino, V. C., Rossi, V., Gatti, A., Patan, P., Cavallo, C., Re, F., Albanese, I., Silvestri, D., Nunzio, A. D. D., & Zuccotti, G. (2023). Exergames to limit weight gain and to fight sedentarism in children and adolescents with obesity. Children. https://doi.org/10.3390/children10060928

Capito, C., Martins, R., Feteira-Santos, R., Virgolino, A., Graa, P., Gregorio, M. J., & Santos, O. (2022). Developing healthy eating promotion mass media campaigns: a qualitative study. Frontiers in Public Health. https://doi.org/10.3389/fpubh.2022.931116

Chen, P. (2024). Obesity in adolescents and young adults in chinese digital media: individual causes, social implications, and policy perspectives. El Profesional de la Informacion. https://doi.org/10.3145/epi.2024.ene.0320

Dixon, H., Scully, M., Wakefield, M., Kelly, B., Pettigrew, S., Chapman, K., & Niederdeppe, J. (2018). The impact of unhealthy food sponsorship vs. pro-health sponsorship models on young adults’ food preferences: a randomised controlled trial. BioMed Central. https://doi.org/10.1186/s12889-018-6298-4

Falbe, J. & Madsen, K. A. (2017). Growing momentum for sugar-sweetened beverage campaigns and policies: costs and considerations. American Public Health Association. https://doi.org/10.2105/ajph.2017.303805

Faras, P. (2020). The use of fear versus hope in health advertisements: the moderating role of individual characteristics on subsequent health decisions in chile. Multidisciplinary Digital Publishing Institute. https://doi.org/10.3390/ijerph17239148

Gerberding, J. & Marks, J. (2004). Making america fit and trim–steps big and small. American Journal of Public Health. https://doi.org/10.2105/AJPH.94.9.1478

Gianfredi, V., Bertarelli, G., Minelli, L., & Nucci, D. (2021). Promoting healthy eating in childhood: results from the coconut (children promoting nutrition throught theatre) project. Minerva Pediatrica. https://doi.org/10.23736/S2724-5276.21.06249-2

Haines, J., Douglas, S., Mirotta, J. A., OKane, C., Breau, R., Walton, K., Krystia, O., Chamoun, E., Annis, A., Darlington, G., Buchholz, A., Duncan, A., Vallis, L., Spriet, L., Mutch, D., Brauer, P., Allen-Vercoe, E., Taveras, E., Ma, D., & Study, O. B. O. T. G. F. H. (2018). Guelph family health study: pilot study of a home-based obesity prevention intervention. Canadian journal of public health. https://doi.org/10.17269/s41997-018-0072-3

Hesketh, K., Campbell, K., Crawford, D., Salmon, J., Ball, K., McNaughton, S., & McCallum, Z. (2011). O1-5.1cluster-randomised controlled trial of an early childhood obesity prevention program: the melbourne infant feeding, activity and nutrition trial (infant) program. Journal of Epidemiology and Community Health. https://doi.org/10.1136/jech.2011.142976a.36

Jeffery, R. (2006). Community approaches to obesity treatment and prevention.

Kraak, V. & Stanley, K. C. (2021). A systematic scoping review of media campaigns to develop a typology to evaluate their collective impact on promoting healthy hydration behaviors and reducing sugary beverage health risks. International Journal of Environmental Research and Public Health. https://doi.org/10.3390/ijerph18031040

Lepeleere, S. D., Bourdeaudhuij, I. D., Cardon, G., & Verloigne, M. (2017). The effect of an online video intervention movie models on specific parenting practices and parental self-efficacy related to childrens physical activity, screen-time and healthy diet: a quasi-experimental study. BioMed Central. https://doi.org/10.1186/s12889-017-4264-1

Llaurad, E., AcevesMartins, M., Tarro, L., Papell-Garcia, I., Puiggrs, F., Arola, L., PradesTena, J., Montagut, M., Fernndez, C. M. M., Sol, R., & Giralt, M. (2015). A youth-led social marketing intervention to encourage healthy lifestyles, the eyto (european youth tackling obesity) project: a cluster randomised controlled0 trial in catalonia, spain. BioMed Central. https://doi.org/10.1186/s12889-015-1920-1

Luo, Y., Maafs-Rodrguez, A. G., & Hatfield, D. P. (2024). The individuallevel effects of social media campaigns related to healthy eating, physical activity, and healthy weight: a narrative review. Obesity Science & Practice. https://doi.org/10.1002/osp4.731

Mandi, D., Bjegovi-Mikanovi, V., Vukovic, D., Djikanovi, B., Stamenkovi, .., & Lalic, N. (2020). Successful promotion of physical activity among students of medicine through motivational interview and web-based intervention. PeerJ. https://doi.org/10.7717/peerj.9495

Mauriello, L., Driskell, M., Sherman, K., Johnson, S. S., Prochaska, J., & Prochaska, J. (2006). Acceptability of a school-based intervention for the prevention of adolescent obesity. Journal of School Nursing. https://doi.org/10.1177/10598405060220050501

Modrzejewska, A., Czepczor-Bernat, K., Modrzejewska, J., Roszkowska, A., Zembura, M., & Matusik, P. (2022). #childhoodobesity a brief literature review of the role of social media in body image shaping and eating patterns among children and adolescents. Frontiers in Pediatrics. https://doi.org/10.3389/fped.2022.993460

Molenaar, A., Saw, W. Y., Brennan, L., Reid, M., Lim, M. S. C., & McCaffrey, T. A. (2021). Effects of advertising: a qualitative analysis of young adults’ engagement with social media about food. Multidisciplinary Digital Publishing Institute. https://doi.org/10.3390/nu13061934

Morley, B., Niven, P., Dixon, H., Swanson, M., McAleese, A., & Wakefield, M. (2018). Controlled cohort evaluation of the<i>livelighter</i>mass media campaigns impact on adults reported consumption of sugar-sweetened beverages. BMJ. Https://doi.org/10.1136/bmjopen-2017-019574

Okpanachi, V. A. & Adaji, I. (2024). The design of food villain, a serious game to influence healthy eating habits among african international students. IEEE Games Entertainment Media Conference. https://doi.org/10.1109/GEM61861.2024.10585723

Osei-Kwasi, H., Akparibo, R., Ojwang, A., Asamane, E., Olayanju, A., & Ellahi, B. (NaN). Design and implementation of a culturally tailored diet and lifestyle intervention for african and caribbean people residing in manchester: insights from a process evaluation. Proceedings of the Nutrition Society. https://doi.org/10.1017/s0029665122002592

Peterson, K. E., Peterson, K. E., Spadano-Gasbarro, J. L., Greaney, M., Greaney, M., Austin, S. B., Austin, S. B., Mezgebu, S., Hunt, A., Blood, E., Horan, C. M., Feldman, H., Osganian, S., Bettencourt, M., & Richmond, T. K. (2015). Three-year improvements in weight status and weight-related behaviors in middle school students: the healthy choices study. PLoS ONE. https://doi.org/10.1371/journal.pone.0134470

Prybutok, V. R., Prybutok, G., & Yogarajah, J. (2024). Social media influences on dietary awareness in children. None. https://doi.org/10.3390/healthcare12191966

Requero, B., Santos, D., Cancela, A., Briol, P., & Petty, R. (2021). Promoting healthy eating practices through persuasion processes. Basic and Applied Social Psychology. https://doi.org/10.1080/01973533.2021.1929987

Robinson, T., Matheson, D., Kraemer, H., Wilson, D. M., Obarzanek, E., Thompson, N. S., Alhassan, S., Spencer, T. R., Haydel, K., Fujimoto, M., Varady, A., & Killen, J. (2010). A randomized controlled trial of culturally tailored dance and reducing screen time to prevent weight gain in low-income african american girls: stanford gems.. Archives of Pediatrics & Adolescent Medicine. https://doi.org/10.1001/archpediatrics.2010.197

Rukmini, E. & Adella, A. (2021). Healthy diet social media campaign among indonesian college students. None. https://doi.org/10.11591/IJPHS.V10I3.20842

Seid, A., Fufa, D. D., & Bitew, Z. (2024). The use of internet-based smartphone apps consistently improved consumers” healthy eating behaviors: a systematic review of randomized controlled trials. None. https://doi.org/10.3389/fdgth.2024.1282570

Selvaraj, S. N., Sriram, A., & S, S. (2024). Impact of obesity-related social media contents on urban men: application of the health belief model. ATHENS JOURNAL OF HEALTH & MEDICAL SCIENCES. https://doi.org/10.30958/ajhms.11-4-4

Sendyana, I. N. T. & Rizkiantono, R. E. (2024). Perancangan kampanye pola hidup rendah gula melalui media sosial sebagai upaya pencegahan obesitas bagi remaja usia 16 -21 tahun. None. https://doi.org/10.12962/j29880114.v1i3.735

Smith, B. J. & Bonfiglioli, C. (2015). Physical activity in the mass media: an audience perspective. Oxford University Press. https://doi.org/10.1093/her/cyv008

Volkova, E., Michie, J., Corrigan, C., Sundborn, G., Eyles, H., Jiang, Y., & Mhurch, C. N. (2017). Effectiveness of recruitment to a smartphone-delivered nutrition intervention in new zealand: analysis of a randomised controlled trial. BMJ. https://doi.org/10.1136/bmjopen-2017-016198

Watanabe-Ito, M., Kishi, E., & Shimizu, Y. (2020). Promoting healthy eating habits for college students through creating dietary diaries via a smartphone app and social media interaction: online survey study. JMIR mHealth and uHealth. https://doi.org/10.2196/17613

Wongtongtair, S., Iamsupasit, S., Somrongthong, R., Kumar, R., & Yamarat, K. (2021). Comparison of mobile health education messages verses face-to-face consultation for weight reduction among overweight female adolescents in thailand. F1000Research. https://doi.org/10.12688/f1000research.51156.2

Works, C. & Miller, J. (2020). Is prolotherapy effective in reducing pain and improving function in patients with knee oa?. None. https://doi.org/10.1097/ebp.0000000000000578

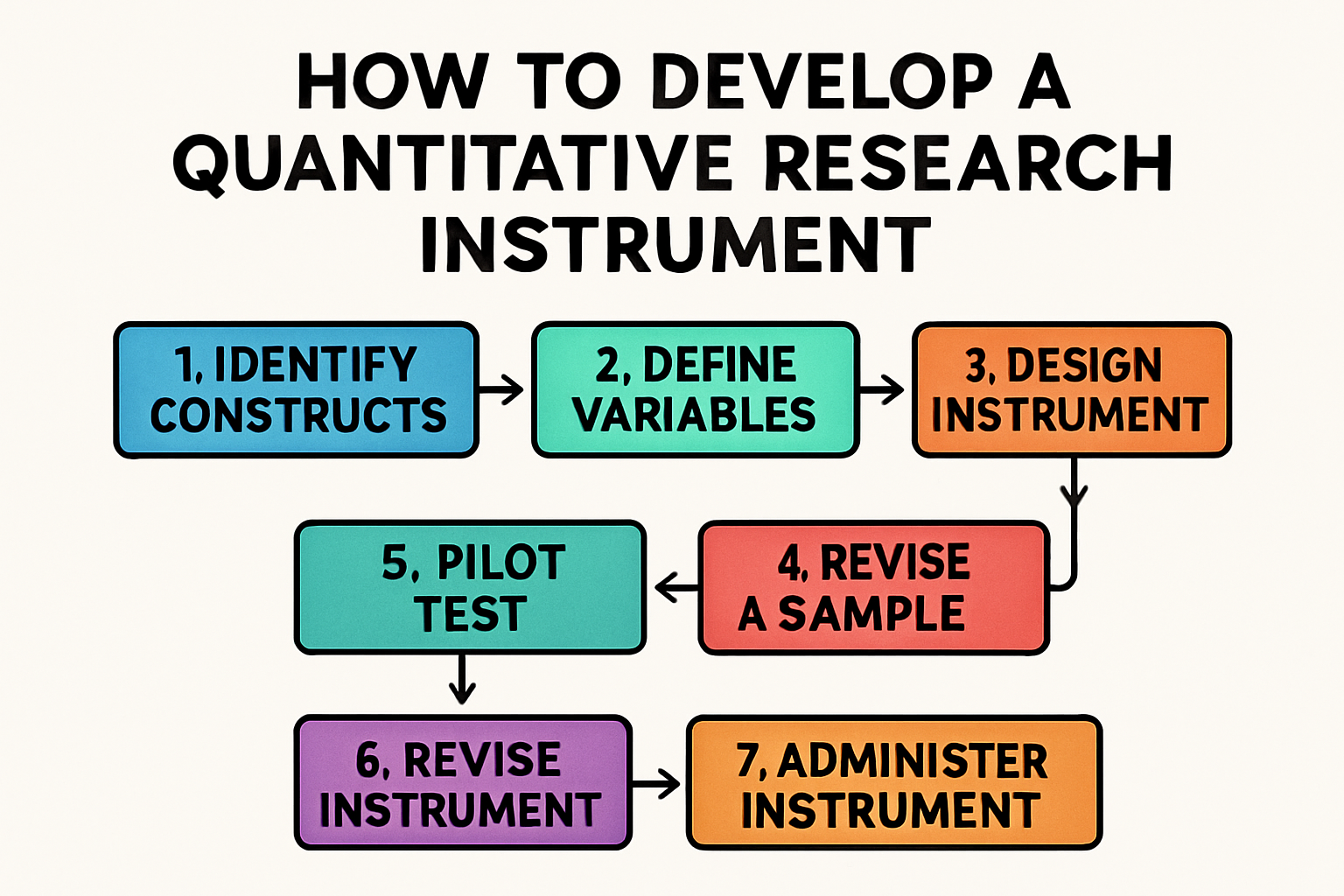

Ideas For Quantitative Research

The global obesity epidemic presents a significant public health challenge (Gerberding, 2004), (Baranowski, 2015), (Tsai, 2019). Addressing this complex issue requires a multifaceted approach, with media interventions playing a crucial role in shaping health behaviors and promoting lifestyle changes (Luo, 2024), (Sendyana, 2024), (Kraak, 2021). However, existing research reveals significant knowledge gaps regarding the effectiveness, long-term impact, and optimal design of various media interventions (Mller, 2010), (Robinson, 2017), (Randolph, 2015). This document outlines ten quantitative research suggestions, directly addressing these knowledge gaps and proposing avenues for more effective obesity prevention and treatment strategies.

Quantitative Research Suggestions

Comparative Effectiveness of Mobile Health Interventions

- Research Question: How do different mHealth interventions (e.g., text messaging, mobile apps with varying levels of interactivity, gamified apps) compare in their effectiveness in promoting weight loss and maintaining healthy behaviors in adults with obesity?

Knowledge Gap: While some mHealth interventions have shown promise (Wongtongtair, 2021), (Randolph, 2015), a direct comparison of different approaches across a large and diverse population is lacking. The effectiveness of text messaging interventions, for instance, has yielded mixed results (Randolph, 2015).

Methodology: A multi-arm RCT comparing multiple mHealth interventions. Participants would be randomly assigned to different intervention groups, each receiving a unique mHealth intervention. Outcome measures would include changes in BMI, waist circumference, physical activity levels, dietary habits, and self-reported adherence to the intervention.

Effectiveness of Culturally Tailored Social Media Campaigns

- Research Question: What is the effectiveness of culturally tailored social media campaigns in promoting healthy eating and physical activity among specific ethnic minority groups, compared to general population campaigns?

Knowledge Gap: While social media interventions show promise (Luo, 2024), (Sendyana, 2024), (Rukmini, 2021), (Acha, 2022), the effectiveness of culturally tailored campaigns in specific populations remains understudied (Obita, 2023). Studies have shown varying results regarding the effectiveness of social media campaigns on behavior change.

Methodology: A cluster-randomized controlled trial (CRCT) comparing culturally tailored campaigns to general population campaigns. Clusters could be schools or communities with significant populations of the target ethnic minority group. Outcome measures would include changes in BMI, dietary habits, physical activity levels, and knowledge of healthy lifestyle choices.

Impact of Mass Media Campaigns on Sugar-Sweetened Beverage Consumption

- Research Question: What is the impact of a comprehensive mass media campaign (television, radio, print, and online advertising) on the consumption of sugar-sweetened beverages (SSBs) and related health outcomes (BMI, waist circumference, blood glucose levels) among adults, compared to a control group?

Knowledge Gap: While some mass media campaigns have shown success in reducing SSB consumption (Morley, 2018), further research is needed to evaluate the long-term effects and the optimal design of these campaigns (Falbe, 2017). The effectiveness of such campaigns can be significantly influenced by the presence of heavy commercial advertising promoting SSBs (Morley, 2018).

Methodology: A controlled before-and-after study design. Data would be collected from a representative sample of adults before and after the campaign using surveys and physiological measurements. The control group would be a similar population in a geographical area not exposed to the campaign.

The Role of Parental Education in Media Intervention Effectiveness

- Research Question: How does maternal education level moderate the effectiveness of media interventions (e.g., online videos, mobile apps) aimed at improving children’s dietary habits and physical activity levels?

Knowledge Gap: The effectiveness of interventions may vary based on parental characteristics (Ball, NaN). Higher educated mothers showed a more significant positive effect on their children’s vegetable consumption, while lower educated mothers saw a greater positive effect on their children’s water consumption due to the intervention (Ball, NaN).

Methodology: An RCT comparing the effectiveness of a media intervention among children whose mothers have different levels of education. Outcome measures would include changes in children’s BMI, dietary habits, and physical activity levels. Moderation analysis would be conducted to assess the influence of maternal education on the intervention’s effectiveness.

Influence of Food Advertising on Social Media on Eating Behaviors

- Research Question: What is the relationship between exposure to unhealthy food advertising on social media and eating behaviors (fast food consumption, snacking frequency, fruit and vegetable intake) among young adults, considering the influence of algorithms and ad-blockers?

Knowledge Gap: The pervasive influence of food advertising on social media on young adults’ eating behaviors is a significant concern (Molenaar, 2021). The use of ad-blockers and algorithms can further complicate this relationship.

Methodology: A cross-sectional study using surveys and social media data analysis. Participants would complete questionnaires about their social media usage, exposure to food advertising, and eating behaviors. Social media data analysis would be used to assess actual exposure to food advertisements.

Effectiveness of Peer-Led Social Media Interventions

- Research Question: How effective are peer-led social media interventions in promoting healthy lifestyle choices (physical activity, healthy eating) among adolescents compared to interventions led by health professionals?

Knowledge Gap: While peer influence is powerful (Llaurad, 2015), (Chung, 2021), a direct comparison of peer-led versus professional-led social media interventions is needed. Studies have shown that peer influence on social media can promote both healthy and unhealthy eating behaviors (Chung, 2021).

Methodology: An RCT comparing peer-led and professional-led social media interventions. Adolescents would be randomly assigned to either a peer-led group or a professional-led group. Outcome measures would include changes in physical activity levels, dietary habits, and self-reported healthy lifestyle choices.

Impact of Framing Effects on Health Messages

- Research Question: How do different message framing strategies (gain-framed vs. loss-framed, fear appeals vs. hope appeals) influence the effectiveness of media interventions aimed at reducing unhealthy eating behaviors among children and adolescents?

Knowledge Gap: The optimal framing of health messages for different age groups and behaviors remains unclear , , . Gain-framed messages have shown promise in increasing awareness and healthy eating behavior among young children .

Methodology: An RCT comparing the effectiveness of different message framing strategies. Participants would be randomly assigned to different groups receiving messages with different frames. Outcome measures would include changes in knowledge, attitudes, and behaviors related to healthy eating.

Effectiveness of Combining Media Interventions and Other Approaches

- Research Question: What is the comparative effectiveness of integrating media interventions (e.g., mobile apps, social media campaigns) with other approaches (e.g., behavioral therapy, family-based interventions) in achieving weight loss and improving health outcomes in obese adults?

Knowledge Gap: The synergistic effects of combining media interventions with other treatment modalities are not well understood (Dietz, 2006), (Hutfless, 2013), (Bray, NaN). Studies have shown that combining behavioral interventions with pharmacotherapy can lead to significant weight loss (Dietz, 2006).

Methodology: An RCT comparing a combined intervention (media intervention plus another approach) to a control group receiving only the other approach. Outcome measures would include changes in BMI, waist circumference, physical activity levels, dietary habits, and quality of life.

Geef een reactie