Fragmentation and Consolidation of Broadcasting and Streaming in the European Union

Abstract

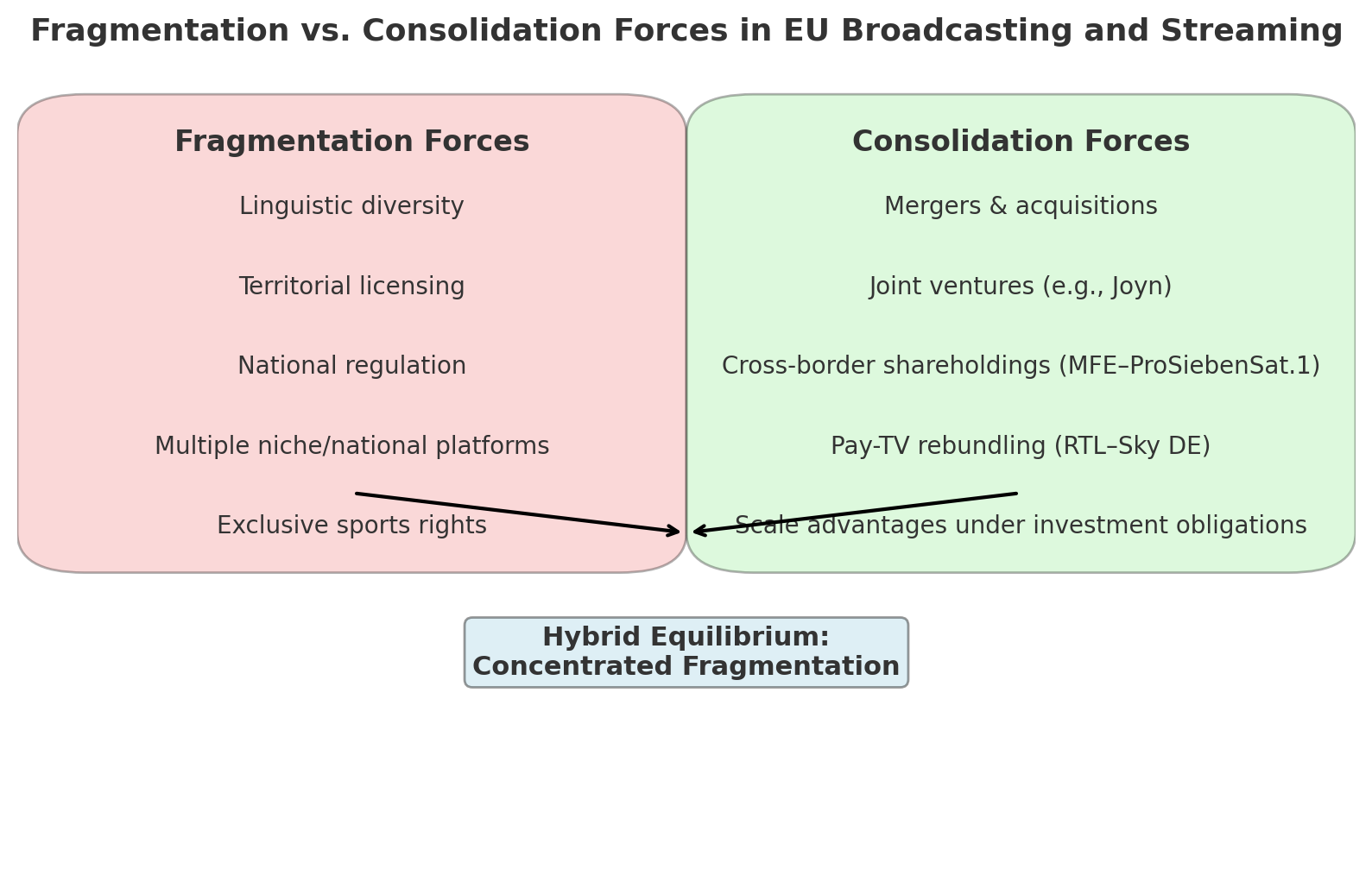

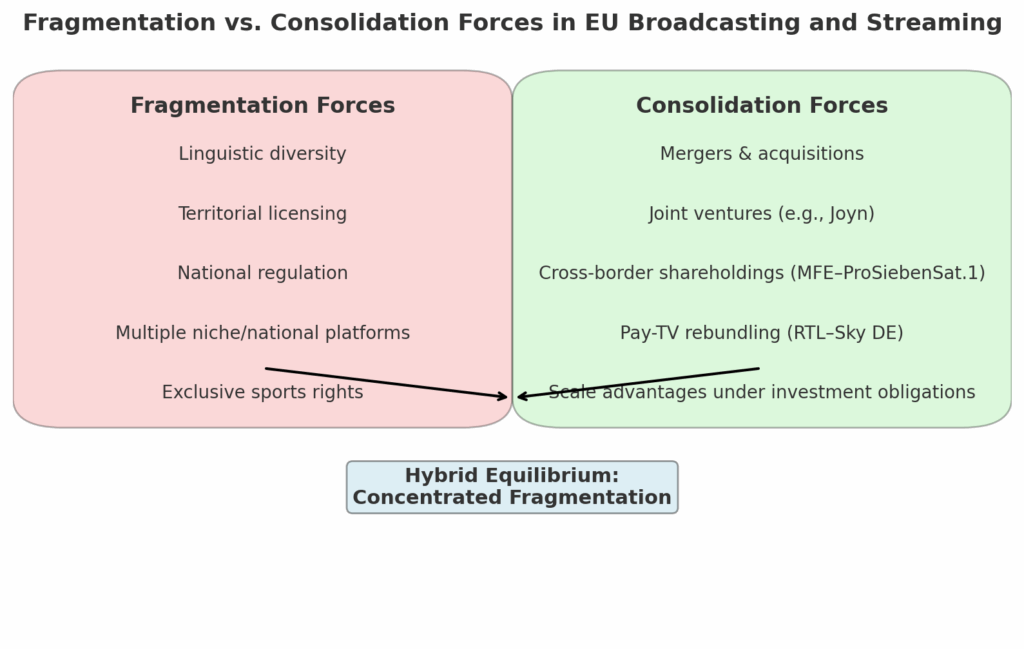

The European Union (EU) audiovisual sector is characterized by a persistent duality: fragmentation and consolidation. Fragmentation arises from linguistic diversity, national regulations, and territorially segmented rights markets, while consolidation is driven by mergers, joint ventures, and cross-border alliances aiming to achieve economies of scale in the face of global competition. This article provides a structured analysis of the dynamics shaping broadcasting and streaming in the EU, focusing on regulatory frameworks (Audiovisual Media Services Directive, Digital Services Act, Digital Markets Act, European Media Freedom Act), market behaviors (rights acquisition, joint ventures, mergers and acquisitions), and the resilience of national broadcasting traditions. The article concludes that Europe displays “concentrated fragmentation”: a few dominant global streamers coexist with a long tail of national services, sustained by cultural and regulatory diversity. Policy instruments reinforce pluralism while constraining horizontal consolidation, resulting in a hybrid equilibrium. Future research should examine the interplay of regulation, consumer welfare, and market sustainability in an increasingly platform-driven media ecosystem.

Keywords: broadcasting, streaming, European Union, fragmentation, consolidation, AVMSD, DMA, DSA, EMFA, competition policy, media pluralism

1. Introduction

Audiovisual media in the EU have historically evolved along national lines, embedded in linguistic and cultural contexts and shaped by distinctive regulatory traditions. The rise of global subscription video-on-demand (SVOD) platforms has transformed consumption patterns, while national broadcasters and telecom operators have sought scale through consolidation strategies. The coexistence of fragmentation and consolidation reflects structural, cultural, and regulatory tensions. This article explores these dynamics in depth, with a focus on the interplay between market forces and EU-level regulation.

2. Structural Sources of Fragmentation

2.1 Linguistic and Regulatory Diversity

The EU audiovisual market is fragmented along linguistic and cultural lines. Consumer preferences are strongly tied to national languages, leading to the persistence of country-specific content schedules and catalogues. The Audiovisual Media Services Directive (AVMSD) institutionalizes this fragmentation by upholding the country-of-origin principle, which allows broadcasters and VoD providers to be regulated in their home state while targeting audiences elsewhere (European Audiovisual Observatory, 2020). While ensuring freedom of circulation, this principle also sustains regulatory diversity across Member States, particularly in advertising, prominence rules, and protection of minors (European Commission, 2020a).

2.2 Rights Windowing and Territorial Licensing

The EU’s audiovisual rights market remains territorially segmented. Sports rights exemplify this phenomenon: the UEFA Champions League rights are fragmented across Amazon Prime Video, DAZN, and national broadcasters depending on the Member State (SportBusiness, 2023a). Similarly, Italian Serie A football rights are sold on an exclusive basis to DAZN, with co-licensees changing in successive cycles (SportBusiness, 2023b). Territorial exclusivity maximizes revenues for rightsholders but perpetuates consumer fragmentation, as audiences require multiple subscriptions to access comprehensive coverage.

2.3 Proliferation of Services

Despite the dominance of global SVODs, a large ecosystem of national and niche services persists. The European Audiovisual Observatory (2023) highlights that Netflix, Amazon, and Disney+ account for most subscriptions, but dozens of national players—including broadcaster-led platforms like RTL+ (Germany), ITVX (UK), and Movistar+ (Spain)—retain market relevance. Fragmentation is further amplified by the rise of free ad-supported television (FAST) and niche AVOD platforms, which cater to specialized audiences.

3. Policy Instruments Influencing Fragmentation and Consolidation

3.1 Quotas and Prominence Rules

The AVMSD requires VoD services to include at least 30% European works in their catalogues and to ensure their prominence (European Commission, 2020a). These provisions promote cultural diversity but may indirectly encourage fragmentation by sustaining localized commissioning rather than incentivizing cross-border catalogues. Compliance monitoring, however, has revealed variations in national enforcement, highlighting uneven impacts across Member States.

3.2 Investment Obligations and Levies

Several Member States impose financial contributions on global streamers. France’s SMAD decree obliges platforms to invest a significant share of revenues into local production (European Commission, 2020b). While this fosters European content creation, it increases compliance costs and creates a market environment where scale is advantageous, potentially tilting the playing field towards established incumbents.

3.3 Media Pluralism Safeguards

The European Media Freedom Act (EMFA) (European Commission, 2024) aims to safeguard editorial independence, ownership transparency, and media pluralism. Though not directly designed as a competition tool, its provisions reinforce scrutiny over concentration and state influence. In this sense, the EMFA complements merger control, indirectly shaping consolidation strategies.

3.4 Platform Regulation: DMA and DSA

The Digital Markets Act (DMA) restricts the gatekeeping power of large online platforms, imposing obligations on firms such as Apple, Amazon, and Google (European Commission, 2023a). The Digital Services Act (DSA) introduces transparency and accountability rules for very large online platforms, including video-sharing services (European Commission, 2023b). Both regulations indirectly affect media discoverability, advertising, and app distribution, altering the balance of power between global tech companies and national broadcasters.

4. Consolidation: Strategies and Outcomes

4.1 Blocked and Abandoned Mergers

Attempts at horizontal consolidation have often faced regulatory resistance. In France, the proposed TF1–M6 merger collapsed in 2022 after the competition authority raised concerns about advertising and content concentration (Autorité de la concurrence, 2022). Similarly, the Dutch RTL–Talpa merger was blocked in 2023 by the ACM, citing risks to competition in TV advertising (ACM, 2023). These cases illustrate strong national safeguards against concentration.

4.2 Cross-Border Shareholdings

In contrast, “soft” consolidation strategies have succeeded. Italy’s MediaForEurope (MFE), formerly Mediaset, accumulated a controlling influence in Germany’s ProSiebenSat.1, securing supervisory board control in 2025 (Financial Times, 2025). Such cross-border shareholdings reflect an emerging strategy for achieving influence without full legal integration.

4.3 Pay-TV and Streaming Rebundling

Legacy pay-TV assets remain central to consolidation strategies. In 2025, RTL Group reached an agreement to acquire Sky Deutschland from Comcast, consolidating sports rights and premium content into its RTL+ service (Variety, 2025). This rebundling illustrates how broadcasters leverage legacy distribution platforms to scale up streaming offerings.

4.4 Joint Ventures

Broadcasters have launched joint ventures to pool content and technology. Joyn in Germany (ProSiebenSat.1 and Warner Bros. Discovery) exemplifies successful cooperation. By contrast, France’s Salto, launched by France Télévisions, TF1, and M6, closed in 2023 due to underperformance and strategic disagreements (Le Monde, 2023). These divergent outcomes reveal the challenges of sustaining national-champion streaming services in competitive environments.

5. Fragmentation through Sports Rights

Sports rights markets are central to understanding consumer-facing fragmentation. Exclusive rights deals for UEFA and Serie A illustrate how fragmentation coexists with consolidation incentives: streamers seek exclusive rights to differentiate, but consumers face subscription stacking and fragmented access (SportBusiness, 2023a; 2023b). This dynamic represents a structural paradox in EU audiovisual markets.

6. Market Outcomes: Concentrated Fragmentation

Europe’s audiovisual market displays “concentrated fragmentation”. A few global platforms dominate market share, yet national services persist, sustained by quotas, levies, and cultural preferences (European Audiovisual Observatory, 2023). This equilibrium reflects a deliberate policy choice to preserve pluralism, even at the cost of efficiency.

7. Suggestions for Further Research

- Cross-border effects of AVMSD quotas: Do prominence obligations promote pan-European discoverability or reinforce national silos?

- Sustainability of broadcaster-led joint ventures: Comparative case studies of Joyn (success) vs. Salto (failure).

- Impact of DMA and DSA on distribution power: How do these regulations alter bargaining between global platforms and national media firms?

- Consumer welfare implications of sports fragmentation: Analysis of subscription stacking and affordability in sports broadcasting.

- Interaction between EMFA and competition law: How will EMFA affect merger control in future media consolidations?

8. Conclusion

The EU broadcasting and streaming ecosystem is shaped by a deliberate balance: fragmentation safeguards cultural diversity and media pluralism, while consolidation strategies respond to competitive pressures from global players. Regulatory frameworks (AVMSD, EMFA, DMA, DSA) sustain this equilibrium by constraining excessive concentration while promoting European works. The result is a hybrid system in which global streamers dominate subscriptions but coexist with national services. Future research should evaluate whether this balance remains sustainable in light of shifting consumer expectations, technological convergence, and the increasing role of platform regulation.

References

- ACM. (2023). ACM blocks merger between RTL Nederland and Talpa Network. Authority for Consumers and Markets.

- Autorité de la concurrence. (2022). The TF1–M6 merger project abandoned after competition concerns.

- European Audiovisual Observatory. (2020). The AVMSD and the country-of-origin principle. Strasbourg: Council of Europe.

- European Audiovisual Observatory. (2023). Market trends: SVOD in Europe. Strasbourg: Council of Europe.

- European Commission. (2020a). Audiovisual Media Services Directive (AVMSD): Guidance on European works quotas. Brussels: Publications Office.

- European Commission. (2020b). Cultural and creative sectors and AVMSD investment obligations. Brussels: Publications Office.

- European Commission. (2023a). Digital Markets Act (DMA): Key provisions and enforcement. Brussels.

- European Commission. (2023b). Digital Services Act (DSA): Overview of obligations. Brussels.

- European Commission. (2024). European Media Freedom Act (Regulation (EU) 2024/1083). Brussels.

- Financial Times. (2025, September). MFE secures control of ProSiebenSat.1’s supervisory board.

- Le Monde. (2023). French streaming platform Salto to shut down.

- SportBusiness. (2023a). Amazon and DAZN secure UEFA Champions League rights across Europe.

- SportBusiness. (2023b). DAZN retains Serie A rights in Italy.

- Variety. (2025, June). RTL to acquire Sky Deutschland from Comcast.

Would you like me to add tables or figures (e.g., a timeline of major consolidation attempts or a diagram of fragmentation forces) to make this article look even more like a scientific journal publication?